december child tax credit amount

If you have not yet claimed the benefit on your taxes you may be entitled to. How much will I receive in 2022.

After Child Tax Credit Payments Begin Many More Families Have Enough To Eat Center On Budget And Policy Priorities

For children under 6 the amount jumped to 3600.

. T he American Rescue Plan allowed for an increase in the Child Tax Credit f or the 2021 tax year. Payments will be deducted. Families that did not receive monthly payments can still claim the full amount of the Child Tax Credit they are eligible for when they file taxes.

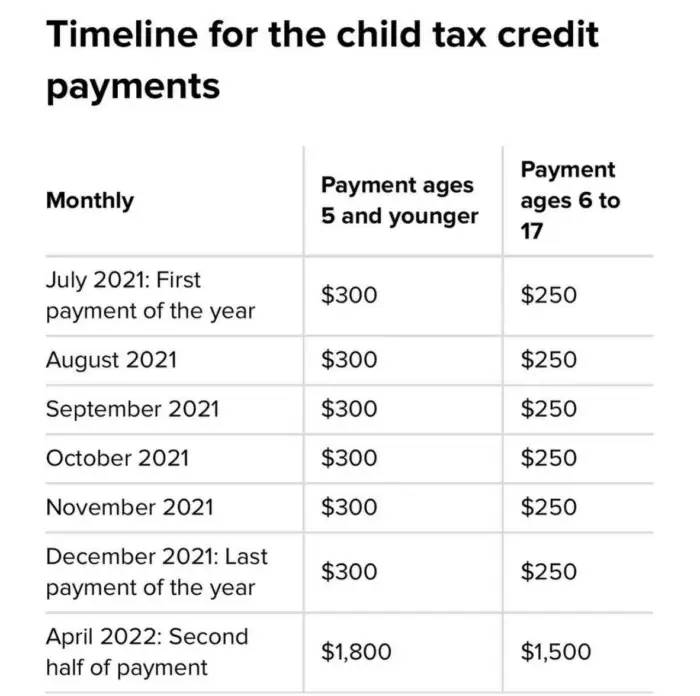

Eligible families who did not receive advance payments can claim the Child Tax Credit on their 2021 federal tax return to receive missed payments and the other half of the. Therefore any families expecting to receive the payment of 250 to 300 per child on December 15 could see this be their last monthly Child Tax Credit payment. The new 2021 US.

The American Rescue Plan increased the amount of the Child Tax Credit from 2000 to 3600. The credit was made fully. The remainder of the credits up to.

When filing your taxes you will get the full amount of Child Tax Credit even if you received less in monthly payments last year than you may have been eligible for. The first change was a temporary increase in the credit amount from 2000 per child to 3000 per child 3600 for children under the age of 5. The credit amount was increased for 2021.

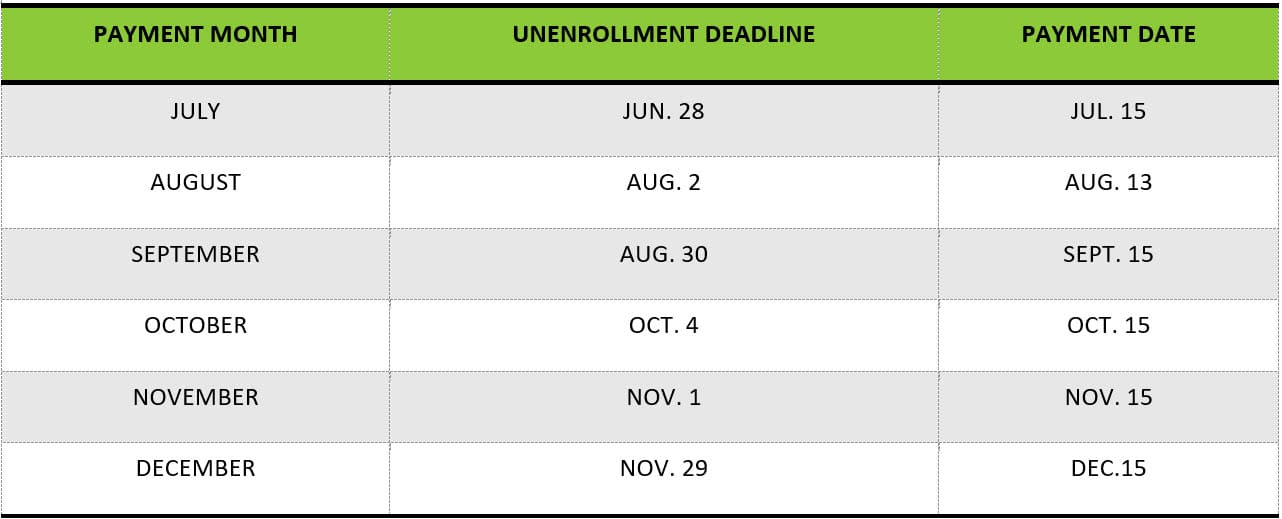

For each qualifying child age 5 and younger up to 1800 half the total will come in six 300 monthly payments this year. For every 1000 the MAGI exceeds the limitations above the amount of tax credit allowed to be claimed is reduced by 50. The next child tax credit check goes out Monday November 15.

The maximum amount of the credit for other dependents for each qualifying dependent who isnt eligible to be claimed for the child tax credit. Visit ChildTaxCreditgov for details. Typically the child tax credit provides up to 300 per month for each child under age 6 and up to 250 per month for each child ages 6-17.

The child tax credits are worth 3600 per child under six in 2021 3000 per child between six and 17 and. Second it granted advance payments from. The American Rescue Plan increased the amount of the Child Tax Credit from 2000 to 3600 for.

For each kid between the ages of 6 and 17 up to 1500. The tax credits maximum amount is 3000 per child and 3600 for. Most Americans Plan To Put Advanced Child Tax Credit Into Savings The child tax credits are worth 3600 per child under six in 2021 3000 per child between six and 17 and 500.

This can include dependents. Under the American Rescue Plan the Child Tax Credit increased so. The maximum Child Tax Credit that parents can receive based on their annual income.

Here is some important information to understand about this years Child Tax Credit. If you have been receiving the Child Tax Credit monthly payments since July you could be given up to 1800 for each child aged five and. You should receive the full amount of the 2021 Child Tax Credit for each qualifying child if you.

In 2021 the enhanced child tax credit meant that taxpayers with children ages 6 to 17 could get a credit of up to 3000. The child tax credits are worth 3600 per child under six in 2021 3000 per child aged between six and 17 and 500 for college students aged up to 24. Why have monthly Child Tax Credit payments.

Under the American Rescue Plan of 2021 advance payments of up to half the 2021 Child Tax Credit were sent to eligible taxpayers. The Child Tax Credit provides money to support American families. This credit has been expanded multiple times most recently during 2021 as part of the American Rescue Plan.

How much is the December Child Tax Credit. A single taxpayer with 2 qualifying children.

Child Tax Credit Don T Throw Away This Letter Before Filing Taxes Woai

Child Tax Credit December Will This Week S Payment Be The Last One Marca

December Child Tax Credit Date Here S When To Expect 1 800 Stimulus Check

Child Tax Credit 2022 Qualifications What Will Be Different Lee Daily

:max_bytes(150000):strip_icc()/child-tax-credit-4199453-FINAL-bc961c42d9a74cbda93039d360debeec.png)

Child Tax Credit Definition How It Works And How To Claim It

Krs And Associates You May Have Questions About The Upcoming Changes To The Child Tax Credit The Credit Amounts Have Been Expanded And Payments Will Start In July And Go Through

Haven T Received Your Advance Payment Of The Child Tax Credit Issued To You Yet

Families Will Soon Receive Their December Advance Child Tax Credit Payment

Child Tax Credit Advanced Payments Information Bc T

Child Tax Credit Who Will Get A Big December Check Kxan Austin

Legislative Momentum In 2022 New And Expanded Child Tax Credits And Eitcs Itep

/cloudfront-us-east-1.images.arcpublishing.com/gray/OFLFFXUVBFGBHHRPXF3OCRM7PA.jpg)

File Taxes For 2021 To Receive Your Full Child Tax Credit

Child Tax Credit 2022 December Payment

Child Tax Credit December How To Still Get 1 800 Per Kid Before 2022 Marca

Child Tax Credit Calculator How Much Will You Get From The Expanded Child Tax Credit Washington Post

Parents Are Getting Another Monthly Child Tax Credit Payment This Month Here S What To Know

Two Ways To Boost Child Tax Credit Payments For December The Us Sun